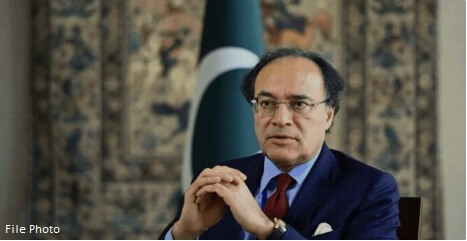

Web Desk — Finance Minister Muhammad Aurangzeb emphasized the government’s efforts to curb revenue leakages while addressing the Overseas Investors Chamber of Commerce and Industry recently, Business Recorder reported. The minister reiterated the government’s resolve to enhance trade and investment while ensuring transparency and efficiency in the revenue system.

Aurangzeb noted that significant steps are being taken to digitize the revenue framework to reduce leakages and promote a client-friendly approach. Citing the beverage sector as an example, he pointed out stark differences in sales tax adjustments claimed by companies in the industry.

Data Analytics to Combat Tax Frauds

To tackle tax fraud, the finance minister revealed that tax authorities are leveraging data analytics to identify irregularities. He stated that the government has already categorized companies’ income and sales tax data by sector to streamline the process.

In the beverage sector, the Federal Board of Revenue (FBR) has set a benchmark tax adjustment rate of 7%, as The Coca-Cola Company practices. However, some companies have claimed adjustments as high as 20%. FBR Chairman highlighted these discrepancies during a press conference in October 2024, according to Business Recorder.

Excess Input Tax Adjustment Unearthed

FBR’s recent study analyzed 16 active cases in the aerated water manufacturing sector, accounting for 99% of the industry’s reported sales. The study revealed that several companies claimed excessive input tax adjustments amounting to Rs15 billion in the fiscal year 2023-2024, surpassing the industry benchmark.

The FBR attributed these discrepancies to questionable claims on inputs such as sugar, plastics, and services. The study further underlined the need for stricter oversight to curb fraudulent tax practices.

(This report is based on information provided by Business Recorder.)